This is the second in a series of articles designed to help the more technical people understand the business. They are intended as general reference material. A copy of the first article, Basics of Accounting: General Ledger and Account Types, can be found here.

Books or ledgers are used to record the transactions. Closing the books is the process that a corporation uses to reconcile, consolidate, and report financial information on a periodic basis. The process usually involves the transfer of account balances from nominal (or temporary) accounts to real (or permanent) accounts and generally involves five steps:

- Closing each of the subledger modules (such as accounts payable or accounts receivable) and posting the detailed transaction information from each module to the general ledger (for more information on the general ledger, please see Basics of Accounting: General Ledger and Account Types).

- Running trial balance reports to confirm that transactions from all modules have been posted correctly.

- Reconciling to the general ledger and making adjusting entries.

- Posting all adjusting entries to the general ledger.

- Running standard financial reports.

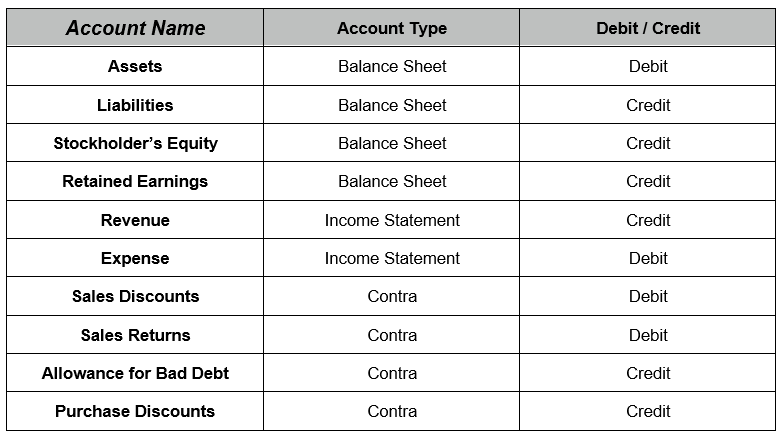

As we noted in Basics of Accounting: General Ledger and Account Types, transactions create either a debit or a credit entry to an account depending on the type of transaction made. Furthermore, debits and credits are treated differently depending on the type of account the transaction is posted to. The following table outlines some common accounts found on financial statements and how they are treated.