Knowing your labor efficiency and your overhead can help you set realistic pricing in your quotes and help you improve your operational efficiency.

The first step in calculating costs is to determine the fully burdened labor cost. This is done by calculating the employee salaries inclusive of vacation time, insurance benefits, and taxes.

Second, you need to figure out how each person in the Finance Department is spending their time. Put together a complete list of tasks completed by members of the team. For example, how many hours are spent paying invoices, preparing manual checks, reconciling bank statements, processing expense reports, etc. The total number of hours spent with your financial operations should be equal to the total allocated annual full-time equivalents (FTEs).

Next, determine the volume of transactions processed for each of the defined metrics for each area that you want to track costs (i.e., number of purchase orders, number of invoices, number of checks, etc.).

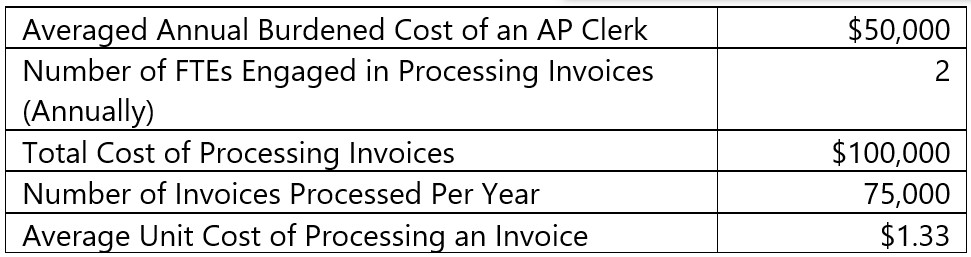

In order to determine the total costs of each transaction type, multiply the average burdened cost by the number of FTEs engaged in a particular task. To calculate the cost per transaction, divide the total cost by the volume of transactions for that activity.

Let’s look at the following example:

In the above example, it costs this organization an average of $1.33 to process each invoice.

Analyzing and Reducing Operating Costs for your Finance Department

Streamlining operating costs adds money directly to the bottom line. In the above example, if the company were able to reduce the cost of processing an invoice to $1.00, then there is a 25% savings in operating costs. These savings are actually worth more to the organization than new revenue because new revenue has a cost of sales associated with it and is generally pre-tax income, while savings to operational costs go directly to the bottom line and can be equivalent to as much as 10 times the value of new sales. So, while a $25,000 saving in this example doesn’t seem like much, it can be equivalent to $250,000 in new sales annually[1], and that is just savings resulting from a single activity.

Steps to Analyze Costs in Finance Operations

- Track your costs by activity

- Create a Process Profile for each activity. This should include the number of FTEs involved in the activity, the total cost of the activity, and the unit cost of each transaction.

- Identify the top resource consuming activities

- Compare different parts of the organization such as different Operating Units or different locations

- Identify the lowest cost for each activity in the organization. For example, one part of the organization may be more efficient in processing invoices, while another operating unit may be more efficient in reconciling expense reports. Identify the total cost for each operating unit and the total cost for the entire organization.

- Identify opportunities for improvement. Define why the lowest cost organization is able to transact either at a higher volume or a reduced labor cost and redefine workflows and business processes to match those of the low-cost organizations.

- Compare your costs to other organizations of the same size and/or in the same industry. Use these as benchmarks and an opportunity to learn industry best practices and to continuously measure your organization against similar entities. Track the benchmark low and the benchmark average for your location, company size, or industry. Identify opportunities to implement leading practices.

- Document Potential Annual Savings if the leading practices were implemented. That is the amount of savings expected per unit times the volume of transactions for that activity. It might be useful to project savings by the industry average and also by the lowest cost.

- Set annual performance targets and continuously monitor progress towards reducing expenses.

- Monitor and publicize the savings within your organization. Calculate the total potential savings across the entire organization and for all activities.

- Reward your team for increased performance.

In my experience, large companies were able to save between $20 million and $40 million annually with these process improvement changes. Generally, the differences are in how many of the transactions are automated, how many of the business processes are lights-out finance without manual intervention, and whether they were able to effectively leverage low-cost operations in a shared services center with a lower cost of labor.

Many companies are hesitant to publish these reduction numbers because they fear that their jobs are the ones that would be cut in the cost-saving measures. However, the savings do not need to result from headcount reductions. Instead, the existing resources and savings can be used to facilitate better decision-making, for taking advantage of diverse marketing initiatives, and to research or enable new initiatives, all of which may increase the value of the company.

[1] https://media.wiley.com/product_data/excerpt/81/04703223/0470322381.pdf