Bankruptcies occur more often than expected and occur during booming economies as well as recessions. Not only was there a sharp increase in bankruptcy filings during the 2020 pandemic, but also law changes and the recession in 2005 and 2009 led to significant slowdowns and many companies unable to meet their debt obligations and operating expenses. This article provides an overview of the bankruptcy process.

Different Kinds of Bankruptcies

In the US, there are two kinds of bankruptcies that companies file for depending on the situation they are in: Chapter 7 or Chapter 11. Chapter 11 allows the debtor to continue business with changes to its financial and organizational structures to potentially return to profitability. If eligible for Chapter 11, the company negotiates with its shareholders to restructure their existing debt and contracts with lower interest rates, less total debt load and more favorable terms. Chapter 11 places the business under the operation of the bankruptcy court and a bankruptcy administer is assigned to determine the impact of the changes on the company’s financial results. Material decisions outside the ordinary course of business are subject to court review and legal motions by creditors.

When the business has little chance of recovery, Chapter 7 allows for complete dissolution of the business and the liquidation of all assets. The value of the remaining assets is distributed according to a list of payees by law. Liquidating the company is usually the last option as it is a heavy loss for both the owners and the shareholders.

This paper focuses on Chapter 11 bankruptcy filings.

Take Action – Evaluate the Options, Determine the Risks, and Plan the Restructuring Roadmap

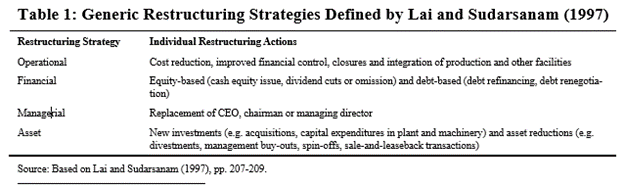

With a Chapter 11 filing, there are several types of changes to the financial and organizational structure for the company. The following table illustrates the primary options:

Plan A for most companies has been to operate within the constraints of their existing financing agreements, which in practice means drawing as much as they can from their existing revolving lines of credit. However, when this and other resources run dry, many companies will find that their liquidity needs, combined with continued earnings pressure, will render their current highly leveraged capital structures untenable, especially with a gradual reopening of the U.S. and other economies. A lot of companies, therefore, will have no choice but to restructure.

Turnaround

Turnaround refers to the process of restructuring, and the outcome of the restructuring process. Either the company is able to overcome the financial distress or it does not survive. It is critical to continuously monitor the effectiveness of the restructuring by comparing the impact and results of each restructuring initiative and establishing metrics to evaluate the overall performance of the company as it develops and implements a restructuring or reorganization strategy. This period of reorganization may provide the company with sufficient time to meet and satisfy its obligations. This extra time may provide the company the opportunity to remove unprofitable aspects of its business and focus on the areas that are most profitable and gives the most return for the shareholders.

[Table 1] Lai, Jim, and Sudi Sudarsanam, 1997, Corporate Restructuring in Response to Performance Decline: Impact of Ownership, Governance and Lenders, European Finance Review 1, 197–233.